Local Lenders

- Home

- Local Lenders - West Central Indiana

Program Details

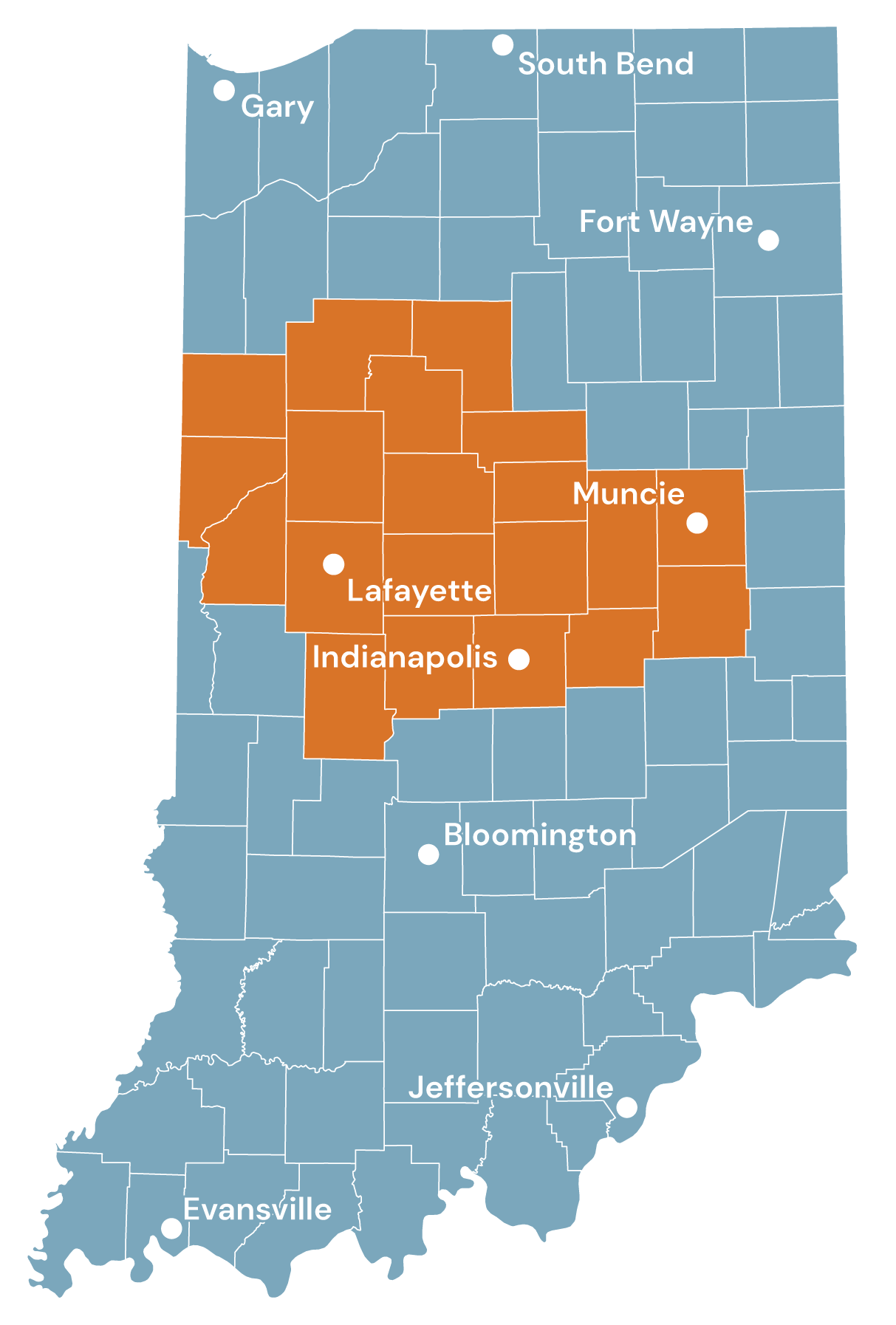

West Central Indiana

Serving the following counties:

Highlighted in Orange

Benton | Boone | Carroll | Cass |

Clinton

Delaware | Fountain | Hamilton | Hancock

Hendricks | Henry | Howard | Madison

Marion | Montgomery |

Putnam

Tippecanoe | Tipton | Warren | White

Mission

The mission of Homestead Resources is to provide education and other resources to increase affordable, sustainable housing opportunities and financial stability in the communities we serve and to be a catalyst for the development and revitalization of our neighborhoods.

Who We Are

Homestead Resources is a non-profit HUD-certified Housing Counseling Agency offering Education and Consulting Assistance to all homeowners and potential homeowners regardless of income. We are a 501(c)(3) non-profit organization. We are governed by a volunteer Board of Directors. We serve families in Tippecanoe, Benton, Boone, Carroll, Clinton, Fountain, Montgomery, Putnam, Warren, and White Counties. Our agency is certified by the State of Indiana to offer HomeBuyer Counseling, Education, and Foreclosure Prevention Counseling. Our counselors are certified by the State of Indiana, NeighborWorks America, and NCHEC to offer Pre and Post-purchase Counseling, Foreclosure Prevention, and Reverse Mortgage Counseling.

Homestead Resources, operating as the Community Loan Center (“CLC”) of West Central Indiana, is licensed and examined under the laws of the State of Indiana and by state law is subject to regulatory oversight by the Indiana Department of Financial Institutions.

Financial Lenders

Investing in the Community Loan Center

The Community Loan Center is seeking grants, loans, and investments. The CLC program puts grant money from foundations and corporate donors to work year after year, re-loaning the grant funds up to 8 times every 5 years. The CLC program delivers measurable positive outcomes demonstrating how the CLC helps borrowers improve their financial health.

Reduced interest rate loans make it possible to bring needed relief to local economies by supporting the CLC. Foundations involved in impact investing can provide Program Related Investments and Mission Related Investments to CLC local lenders. Bank loans for CLC capital provide an excellent way to fulfill bank Community Reinvestment Act obligations.

Social investors may invest in the Community Loan Center directly. By accepting a modest rate of return on investments, private companies, religious institutions, nonprofit organizations or individuals can make a difference in their communities by supporting the Community Loan Center.

Contact Us

FOR ADDITIONAL INFORMATION ABOUT THE COMMUNITY LOAN CENTER PLEASE CONTACT:

Marie Morse, Executive Director

Homestead Resources

671 N 36th St

Lafayette, IN 47901

765.423.1284