Local Lenders

- Home

- Local Lenders - Northeast Indiana

Program Details

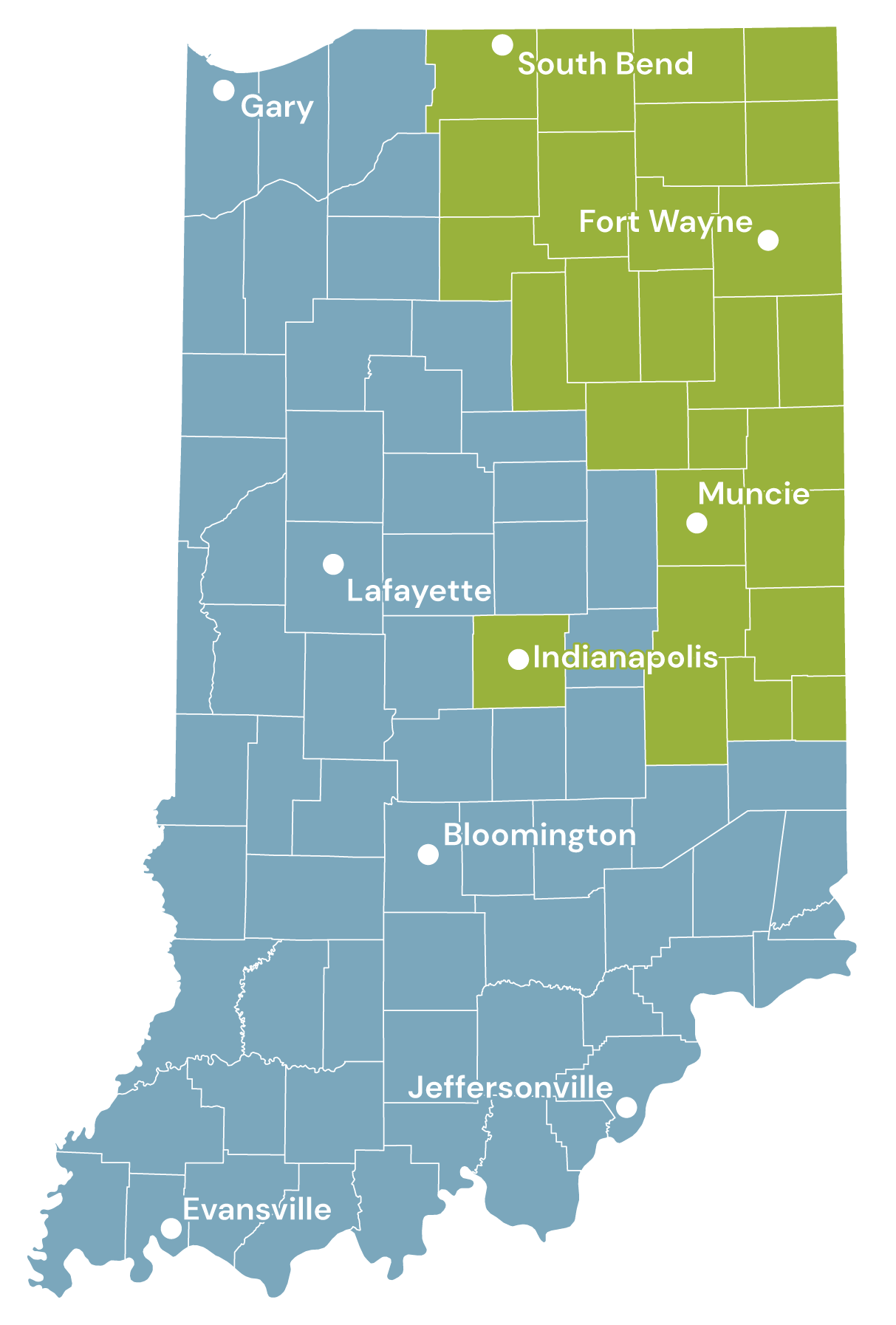

Northeast Indiana

Serving the following counties:

Highlighted in Green

Allen |

Adams |

Blackford |

DeKalb

Delaware |

Elkhart |

Fayette |

Fulton |

Grant

Henry |

Huntington |

Jay |

Kosciusko |

LaGrange

Marion |

Marshall |

Miami |

Noble

Randolph |

Rush |

St. Joseph |

Steuben

Union |

Wabash |

Wayne |

Wells |

Whitley

Mission

Brightpoint helps communities, families, and individuals remove the causes and conditions of poverty.

Who We Are

In 1965, William G. Williams helped start the Allen County Economic Opportunity Council (ACEOC.) During his administration, the ACEOC operated 11 varied programs, including Head Start, Legal Services, Neighborhood Youth Corps, Economic Development, Emergency Food and Medical Services, Youth Development, Neighborhood Services System, Foster Grandparents, and Planning and Research. Several of these programs are still in existence in some form. In 1983, the ACEOC became Community Action of Northeast Indiana, Inc. (CANI) as the service area expanded to include additional communities outside Allen County.

In 2015, as the agency approached 50 years of helping people in the communities where we live and work, the name was changed once again to Brightpoint.

Brightpoint is a private, non-profit agency that promotes economic and community development by providing resources, helping people gain access to opportunities, and teaching them the skills they need to become self-sufficient.

Brightpoint, operating as the Community Loan Center (“CLC”) of Northeast Indiana, is licensed and examined under the laws of the State of Indiana and by state law is subject to regulatory oversight by the Indiana Department of Financial Institutions. Brightpoint is proud to provide this affordable, risk-free alternative to payday and car title loans. All earnings are reinvested into the program for expansion and lending capital.

Financial Lenders

Investing in the Community Loan Center

The Community Loan Center is seeking grants, loans, and investments. The CLC program puts grant money from foundations and corporate donors to work year after year, re-loaning the grant funds up to 8 times every 5 years. The CLC program delivers measurable positive outcomes demonstrating how the CLC helps borrowers improve their financial health.

Reduced interest rate loans make it possible to bring needed relief to local economies by supporting the CLC. Foundations involved in impact investing can provide Program Related Investments and Mission Related Investments to CLC local lenders. Bank loans for CLC capital provide an excellent way to fulfill bank Community Reinvestment Act obligations.

Social investors may invest in the Community Loan Center directly. By accepting a modest rate of return on investments, private companies, religious institutions, nonprofit organizations or individuals can make a difference in their communities by supporting the Community Loan Center.

Financial Education

Financial Literacy classes are offered utilizing the FDIC Money Smart curriculum, a financial education program. Financial education is a key to financial stability, understanding how credit and banking services operate can lead to financial confidence.

Eligibility

Open to the general public.

How to Access

Brightpoint has two ways to access our financial education program: attend our scheduled workshops or go through the FDIC Money Smart Curriculum online. Both options are free of charge.

Workshops

Please check our events calendar to find the details of our upcoming workshops. If you are interested in attending an upcoming financial education workshop you will need to register by contacting us at CED@mybrightpoint.org or 260-399-4108 ext. 601.

Online Financial Education

To access the FDIC Money Smart Curriculum you will need to go to their website and register. Once registered you have access to all the different modules listed, from an introduction to bank services to purchasing a home. If you are unable to complete a module, you are able to save your progress and log back in at a later time.

Contact Us

If you have any questions about Brightpoint’s financial education program please click here to contact us by email. Call 260-399-4108 ext. 601.

Brightpoint

227 E. Washington Blvd.

Fort Wayne, IN 46802

ced@mybrightpoint.org

www.mybrightpoint.org